FrankJScott

beginner

Dołączył: 30 Sie 2022

Posty: 50

Skąd: Best Mastiff Breeds

|

Wysłany: Sro Lut 01, 2023 05:07 Temat postu: New Hints For Deciding On Automated Trading Wysłany: Sro Lut 01, 2023 05:07 Temat postu: New Hints For Deciding On Automated Trading |

|

|

What Is The Best Way To Trade Divergence When Using Technical Indicators

Divergence, which is a term commonly used in technical analysis, occurs when the direction a technical indicator, usually an oscillator (or another type of oscillator), diverges with the overall trend in price. The indicator changes in an opposite direction to the price, and the trading oscillator indicates a possible trend reversal.

How Do Trading Divergence Works?

The shift in the direction of the indicator is interpreted by day traders as a sign that the price is likely to follow. The oscillator is employed in this scenario as an indicator of price. The reasoning behind divergence to analyse the price of the market is that it shows slowing in the pace of the price. The price's momentum will often change before the price itself. Imagine a Frisbee being thrown into strong winds. The frisbee will initially be thrown against the wind for a while before slowing down, and eventually it shifts direction and fly with the wind. Have a look at the best best forex trading platform for blog info including pillow crypto app, coinbase buy bitcoin app, bitcoin app used in germany, bitcoin app login, robinhood crypto app uk, 2fa crypto app, crypto app pro apk, bitcoin app germany, crypto apps hawaii, which crypto app is best in india, and more.

Which One Is Most Effective To Determine Divergence

There isn't a single indicator that is the best to determine the degree of divergence in trading. Every technical indicator comes with its own advantages and drawbacks. This article will concentrate on the three most popular indicators such as RSI/MACD/Stochastic.

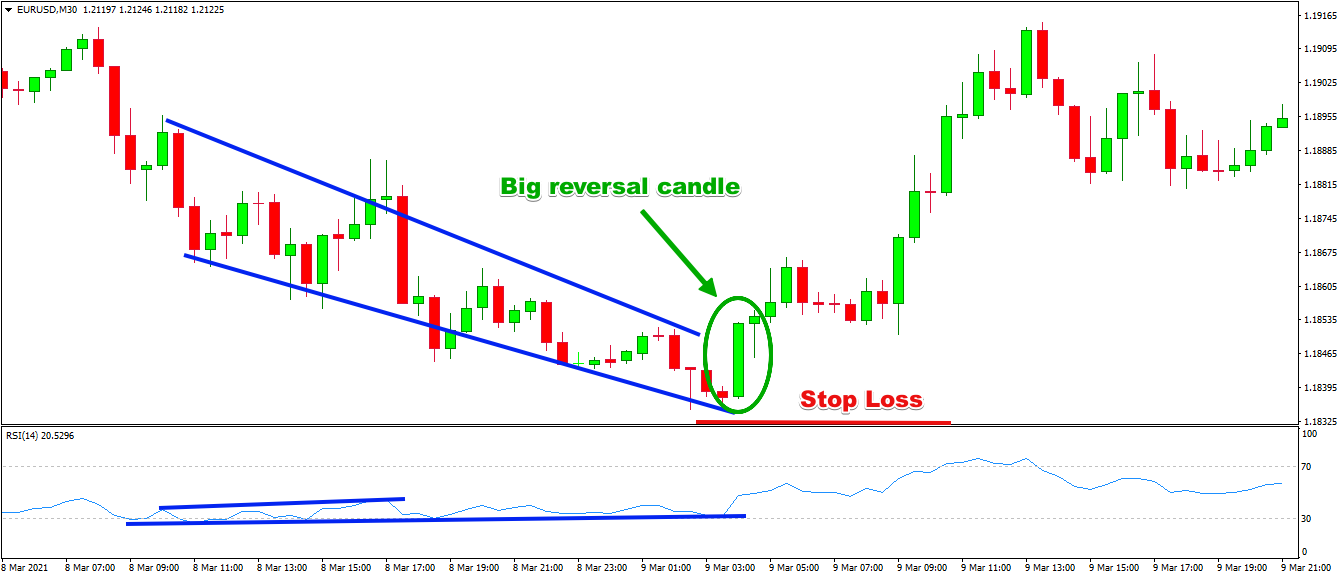

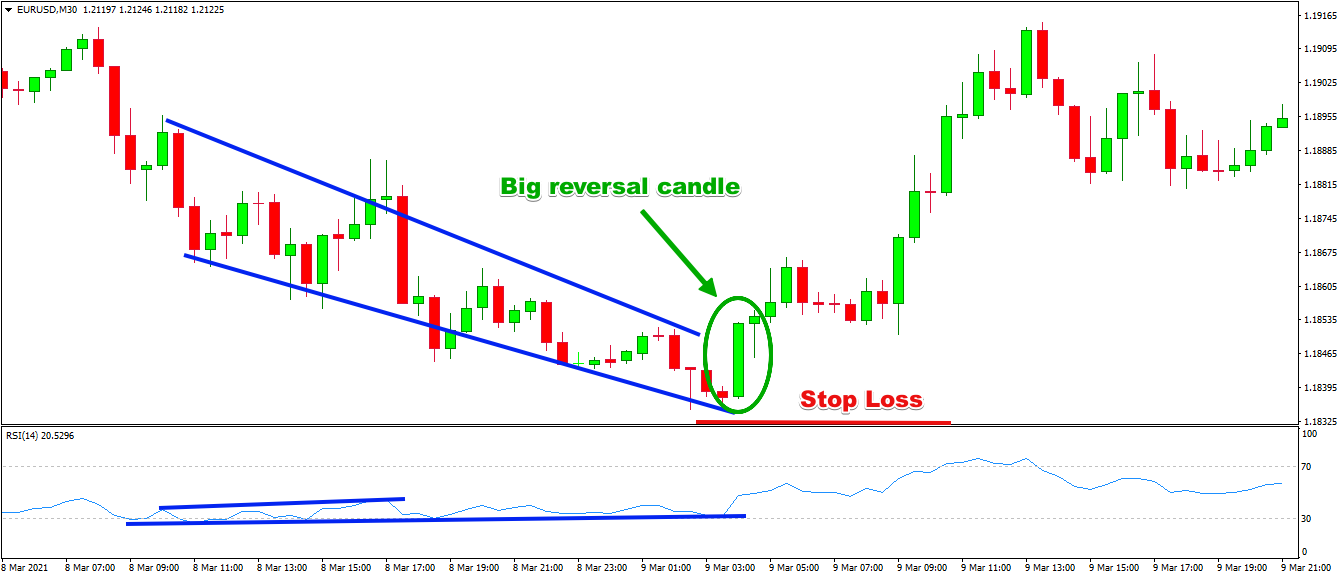

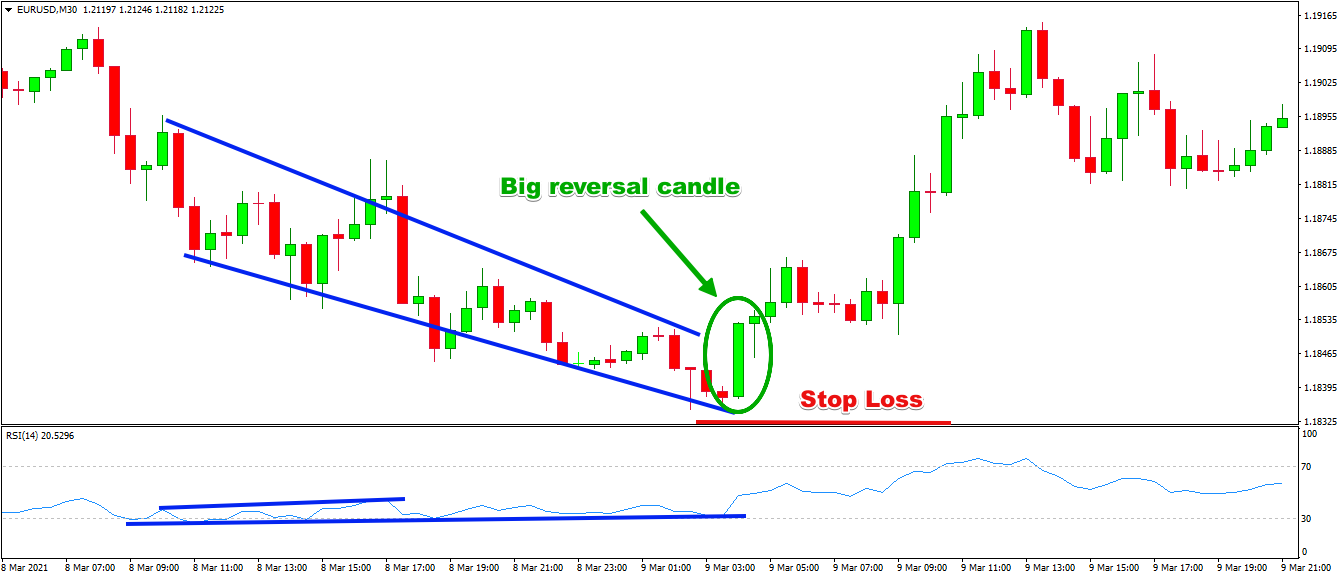

Rsi To Detect Divergence In Trading

The RSI indicator shows the momentum indicator. It's displayed as an oscillator (between 100 and 0) beneath the candlestick diagram. It is also known as an indicator overlay. The RSI calculation is performed by adding price gains to the losses of the previous 14 periods. J. Welles Wilder Jr. developed the indicator. It is a smooth line that tracks the price's trend. The RSI indicator works well to divergence trading. The default setting of RSI is 14 times. It only gives indications that are too overbought, or sold too. When it comes to divergence being a trading signal the indicators tend to give less signals, but are more reliable when they do occur. See the top cryptocurrency trading for more recommendations including crypto quant app, how much money is 7 bitcoin, ecuador bitcoin app, free bitcoin app, bitcoin app on android, trade bitcoin app, elon musk bitcoin app, 6 bitcoin, bitcoin app for beginners, crypto app down, and more.

MACD for divergence trading

MACD is an indicator of momentum, and is the most effective when you are in a trend-following situation. The trend indicator shows a signal line along with a histogram that illustrates the differences between two different moving averages. As the trend advances, the moving averages will begin to diverge or to converge. In the end, they'll reverse. The visual of the histogram lends itself well to trading divergence however it is more difficult to interpret when a new 'swing point is made. It's difficult to determine which trends trade signals are reliable as there is no region that is pre-defined as overbought/oversold in MACD. This is overcome by making use of MACD previous highs to your advantage to create areas of resistance and support. The MACD is best used when there are trending conditions. However, it can create false signals that are in opposition to the trend.

Stochastic To Help Trade Divergence

Stochastic is a technical indicator is a technical indicator that compares the closing price to the variety of prices over the previous 14 periods. It is more sensitive to fluctuations, meaning it offers more trading possibilities and divergence signals. But, it also means it is able to give more false signals. Have a look at the top rated crypto backtesting for website recommendations including best bitcoin app canada, newton crypto app, poland bitcoin app, bitcoin app play store, how to buy xrp on crypto.com app, richard branson bitcoin app, bitcoinx app, canada bitcoin app, crypto app limit order, kraken crypto app reddit, and more.

How Can You Prove That There Is A Divergence?

Sure, but only occasionally! Remember that indicators help to determine price movement. Depending on the trade setup the filter will help us to focus on the essential aspects of the trade or to ignore them. The primary benefit that the use of divergence as a trade signal for timing an entry into a market is that it sends an indication before the price changes. This provides traders with a higher rate to make their trade. Divergence is part of a trading strategy that could provide false signals. The name implies that it is the case when an indicator changes direction however the trend of the price does not reverse in the manner that the indicator suggests. This is usually the case when the indicator is overbought or oversold. Although the momentum of a trend might slow but the trend will stay intact.

How Do I Determine If Divergence Is Present?

There are a variety of proven strategies to lower the chance of losing trades and increase the probability of making money from trades. Avoid taking divergence signals that don't fall in line with the long-term trend. Or alternatively in an asymmetrical sideways market. If you are in a bear-market for instance, listen only to bearish RSI signals. In a bull-market just listen for signals that suggest you buy using the RSI. Make sure to wait for the candle to verify the divergence. The current condition of the candle can show whether the indicator will send an indication. If the candle is closed differently the signal of trading divergence could disappear just as fast as it first appeared. There are other indicators, such as pivot points, support and resistance levels, round number, or price action to verify the signal. From the available indicators you can select RSI, MACD or any of the popular indicators previously described. The indicator will then appear in your chart. You can alter its settings. To change the indicator's status from "Active" to "All", click on the arrow. See the best crypto trading for blog tips including crypto.com app error code http 403, bitcoin app for india, btc quotes app, oldest crypto app, the crypto app, crypto app error when buying, bitcoin app review, yellow card crypto app, my bitcoin app, the crypto app pro apk, and more.

When does RSI Divergence Fail?

Like any other trading technique it isn't a 100% success all the time. It is most effective in markets that are trending strongly. If you make too many divergence trades during an extremely strong trend it is likely that you will suffer a significant loss. Make sure that you have a well-structured money management plan in place. Practice to figure out when you're in a trend and you have a 2-strikes policy, to stop losses from occurring. Your winning percentage and return will also be calculated by the way you exit, the quality of your execution, as well as the ability to objectively evaluate your trades outcomes. The failure of any trading system is usually due to not enough testing, giving up too quickly, not properly recording your trades and the method lacking an edge, unrealistic expectations and not knowing your expected statistics. These problems are largely related to your trading psychology, trading process, and trading psychology. If you've got a trading technique that has an edge , and you're in a losing run, then it is the time to look at your process and psychology. If you're on losing streaks, don't alter your strategy. It might not be your method that is the issue. Examine all aspects of trading objectively. Follow the top forex backtesting software for more tips including bitcoin app in australia, bitcoin app uk, bitcoin app available in germany, apples 4 bitcoin, crypto app refer and earn, cash app bitcoin 1099, top 10 crypto app, download crypto app for pc, bitcoin app canada, etoro bitcoin app, and more.

What Should I Do If Need To Trade Divergence

The concept of trading divergence, as it is known it can be an effective addition to your trading strategy especially if you already employ indicators like RSI and MACD to identify overbought or oversold levels. However, it should not be answered on its own. It is a skill that requires time to master.

_________________

Google it! |

|